As the Central Bank of Nigeria begins the implementation of the $2.5bm currency swap agreement, financial experts have said that the deal would rapidly boost Nigeria’s foreign reserves position it within the next few weeks.

As the Central Bank of Nigeria begins the implementation of the $2.5bm currency swap agreement, financial experts have said that the deal would rapidly boost Nigeria’s foreign reserves position it within the next few weeks.

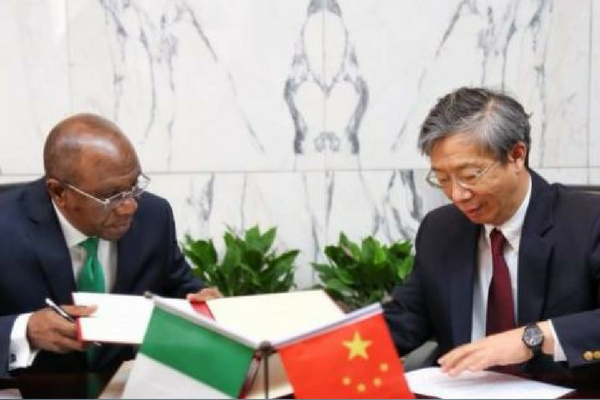

The implementation signalled the consummation of the Bilateral Currency Swap Agreement signed with the People’s Bank of China early this year

Head, Banking and Finance Department, Nasarawa State University, Keffi, Prof Uche Uwaleke said the transaction, valued at Remnibi 16 billion ($2.5bn), will provide adequate local currency liquidity to Nigerian and Chinese industrialists.

This, he noted, would help to reduce the difficulties encountered in the search for third currencies in the execution of business transactions between Nigerian and Chinese industrialists.

Uwaleke added that the agreement would improve the speed, convenience and volume of transactions between the two countries