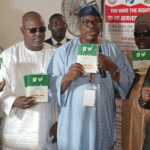

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

Speaking at a retreat in Lagos, the group focused on leveraging on technology to achieve their set goals.

Despite efforts by concerned regulatory authorities to curb financial fraud and clean up the banking system, Nigerian banks recorded 20,768 cases costing them N19.77 billion in the first 6 months of 2018.

The association of chief compliance officers of banks in Nigeria has been the rallying point of matters concerning anti money laudering and terrorism financing amidst other financial crimes.

Compliance officers are now leveraging on digital revolution to reposition their functions in Nigerian banks….

For the Central bank of Nigeria and Nigeria financial intelligence unit, operators must come up with reports that will help in tracking fraudulent activities.

The association is focused on deepening cooperation among its members in the fight against money laudering, terrorism financing, fraud and other criminal activities in the financial services industry and the country at large.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

Speaking at a retreat in Lagos, the group focused on leveraging on technology to achieve their set goals.

Despite efforts by concerned regulatory authorities to curb financial fraud and clean up the banking system, Nigerian banks recorded 20,768 cases costing them N19.77 billion in the first 6 months of 2018.

The association of chief compliance officers of banks in Nigeria has been the rallying point of matters concerning anti money laudering and terrorism financing amidst other financial crimes.

Compliance officers are now leveraging on digital revolution to reposition their functions in Nigerian banks….

For the Central bank of Nigeria and Nigeria financial intelligence unit, operators must come up with reports that will help in tracking fraudulent activities.

The association is focused on deepening cooperation among its members in the fight against money laudering, terrorism financing, fraud and other criminal activities in the financial services industry and the country at large.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

Speaking at a retreat in Lagos, the group focused on leveraging on technology to achieve their set goals.

Despite efforts by concerned regulatory authorities to curb financial fraud and clean up the banking system, Nigerian banks recorded 20,768 cases costing them N19.77 billion in the first 6 months of 2018.

The association of chief compliance officers of banks in Nigeria has been the rallying point of matters concerning anti money laudering and terrorism financing amidst other financial crimes.

Compliance officers are now leveraging on digital revolution to reposition their functions in Nigerian banks….

For the Central bank of Nigeria and Nigeria financial intelligence unit, operators must come up with reports that will help in tracking fraudulent activities.

The association is focused on deepening cooperation among its members in the fight against money laudering, terrorism financing, fraud and other criminal activities in the financial services industry and the country at large.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

Speaking at a retreat in Lagos, the group focused on leveraging on technology to achieve their set goals.

Despite efforts by concerned regulatory authorities to curb financial fraud and clean up the banking system, Nigerian banks recorded 20,768 cases costing them N19.77 billion in the first 6 months of 2018.

The association of chief compliance officers of banks in Nigeria has been the rallying point of matters concerning anti money laudering and terrorism financing amidst other financial crimes.

Compliance officers are now leveraging on digital revolution to reposition their functions in Nigerian banks….

For the Central bank of Nigeria and Nigeria financial intelligence unit, operators must come up with reports that will help in tracking fraudulent activities.

The association is focused on deepening cooperation among its members in the fight against money laudering, terrorism financing, fraud and other criminal activities in the financial services industry and the country at large.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

Speaking at a retreat in Lagos, the group focused on leveraging on technology to achieve their set goals.

Despite efforts by concerned regulatory authorities to curb financial fraud and clean up the banking system, Nigerian banks recorded 20,768 cases costing them N19.77 billion in the first 6 months of 2018.

The association of chief compliance officers of banks in Nigeria has been the rallying point of matters concerning anti money laudering and terrorism financing amidst other financial crimes.

Compliance officers are now leveraging on digital revolution to reposition their functions in Nigerian banks….

For the Central bank of Nigeria and Nigeria financial intelligence unit, operators must come up with reports that will help in tracking fraudulent activities.

The association is focused on deepening cooperation among its members in the fight against money laudering, terrorism financing, fraud and other criminal activities in the financial services industry and the country at large.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

Speaking at a retreat in Lagos, the group focused on leveraging on technology to achieve their set goals.

Despite efforts by concerned regulatory authorities to curb financial fraud and clean up the banking system, Nigerian banks recorded 20,768 cases costing them N19.77 billion in the first 6 months of 2018.

The association of chief compliance officers of banks in Nigeria has been the rallying point of matters concerning anti money laudering and terrorism financing amidst other financial crimes.

Compliance officers are now leveraging on digital revolution to reposition their functions in Nigerian banks….

For the Central bank of Nigeria and Nigeria financial intelligence unit, operators must come up with reports that will help in tracking fraudulent activities.

The association is focused on deepening cooperation among its members in the fight against money laudering, terrorism financing, fraud and other criminal activities in the financial services industry and the country at large.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

Speaking at a retreat in Lagos, the group focused on leveraging on technology to achieve their set goals.

Despite efforts by concerned regulatory authorities to curb financial fraud and clean up the banking system, Nigerian banks recorded 20,768 cases costing them N19.77 billion in the first 6 months of 2018.

The association of chief compliance officers of banks in Nigeria has been the rallying point of matters concerning anti money laudering and terrorism financing amidst other financial crimes.

Compliance officers are now leveraging on digital revolution to reposition their functions in Nigerian banks….

For the Central bank of Nigeria and Nigeria financial intelligence unit, operators must come up with reports that will help in tracking fraudulent activities.

The association is focused on deepening cooperation among its members in the fight against money laudering, terrorism financing, fraud and other criminal activities in the financial services industry and the country at large.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

President of the Association of Compliance Officers of Banks in Nigeria said members have repositioned themselves to attack criminal issues in the banking sector ranging from Money laundering to terrorism financing.

Speaking at a retreat in Lagos, the group focused on leveraging on technology to achieve their set goals.

Despite efforts by concerned regulatory authorities to curb financial fraud and clean up the banking system, Nigerian banks recorded 20,768 cases costing them N19.77 billion in the first 6 months of 2018.

The association of chief compliance officers of banks in Nigeria has been the rallying point of matters concerning anti money laudering and terrorism financing amidst other financial crimes.

Compliance officers are now leveraging on digital revolution to reposition their functions in Nigerian banks….

For the Central bank of Nigeria and Nigeria financial intelligence unit, operators must come up with reports that will help in tracking fraudulent activities.

The association is focused on deepening cooperation among its members in the fight against money laudering, terrorism financing, fraud and other criminal activities in the financial services industry and the country at large.