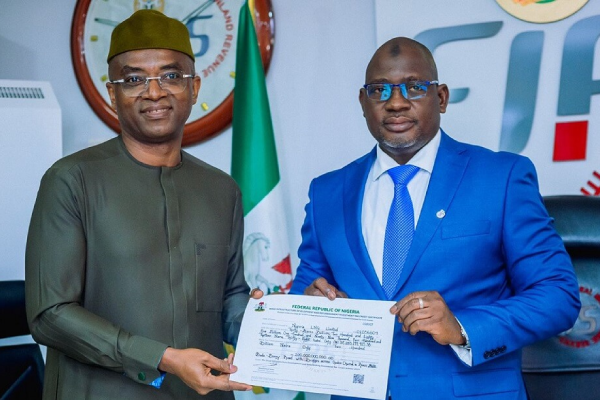

The Nigeria Liquefied Natural Gas Limited (NLNG) has received its tax credit certificate from the Federal Inland Revenue Service (FIRS) for the construction of the Bonny-Bodo Road in Rivers State.

The company is one of those engaged in building roads under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The certificate was received by the Company’s Deputy Managing Director, Mr Olalekan Ogunleye, who represented the Chief Executive Officer of NLNG, Mr. Philip Mshelbila at the handover ceremony held at the FIRS Headquarters, Abuja.

Executive Chairman, FIRS, Muhammad Nami commended the NLNG for its increased investments in Nigeria while issuing the tax credit certificate.

Mr Nami used the opportunity to highlight how the Service was improving on its relations with stakeholders, as well as building a customer-centric tax authority for improved revenue generation.

In order to efficiently deliver on its mandate, he said the Board and Management of the Service is focused on the various strategic action areas.

He said the FIRS is energising its consultations and regular engagements with stakeholders; building a customer centric and data centric organisation while also restructuring the administrative framework and processes of the Service as well as driving towards full automation of core tax operations.

The NLNG Boss in his remarks noted that the company was a major contributor to the country’s economic development and is working towards building a better Nigeria.

He also commended the FIRS for being at the forefront of economic resuscitation and progress the country is experiencing.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, also referred to as the Road Infrastructure Tax Credit Scheme is a public-private partnership scheme signed by President Muhammadu Buhari under Executive Order 007, in January 2019, that enables the Federal Government of Nigeria to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax to the tune of the project cost incurred in the construction or refurbishment of eligible roads.

The Nigeria Liquefied Natural Gas Limited (NLNG) has received its tax credit certificate from the Federal Inland Revenue Service (FIRS) for the construction of the Bonny-Bodo Road in Rivers State.

The company is one of those engaged in building roads under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The certificate was received by the Company’s Deputy Managing Director, Mr Olalekan Ogunleye, who represented the Chief Executive Officer of NLNG, Mr. Philip Mshelbila at the handover ceremony held at the FIRS Headquarters, Abuja.

Executive Chairman, FIRS, Muhammad Nami commended the NLNG for its increased investments in Nigeria while issuing the tax credit certificate.

Mr Nami used the opportunity to highlight how the Service was improving on its relations with stakeholders, as well as building a customer-centric tax authority for improved revenue generation.

In order to efficiently deliver on its mandate, he said the Board and Management of the Service is focused on the various strategic action areas.

He said the FIRS is energising its consultations and regular engagements with stakeholders; building a customer centric and data centric organisation while also restructuring the administrative framework and processes of the Service as well as driving towards full automation of core tax operations.

The NLNG Boss in his remarks noted that the company was a major contributor to the country’s economic development and is working towards building a better Nigeria.

He also commended the FIRS for being at the forefront of economic resuscitation and progress the country is experiencing.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, also referred to as the Road Infrastructure Tax Credit Scheme is a public-private partnership scheme signed by President Muhammadu Buhari under Executive Order 007, in January 2019, that enables the Federal Government of Nigeria to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax to the tune of the project cost incurred in the construction or refurbishment of eligible roads.

The Nigeria Liquefied Natural Gas Limited (NLNG) has received its tax credit certificate from the Federal Inland Revenue Service (FIRS) for the construction of the Bonny-Bodo Road in Rivers State.

The company is one of those engaged in building roads under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The certificate was received by the Company’s Deputy Managing Director, Mr Olalekan Ogunleye, who represented the Chief Executive Officer of NLNG, Mr. Philip Mshelbila at the handover ceremony held at the FIRS Headquarters, Abuja.

Executive Chairman, FIRS, Muhammad Nami commended the NLNG for its increased investments in Nigeria while issuing the tax credit certificate.

Mr Nami used the opportunity to highlight how the Service was improving on its relations with stakeholders, as well as building a customer-centric tax authority for improved revenue generation.

In order to efficiently deliver on its mandate, he said the Board and Management of the Service is focused on the various strategic action areas.

He said the FIRS is energising its consultations and regular engagements with stakeholders; building a customer centric and data centric organisation while also restructuring the administrative framework and processes of the Service as well as driving towards full automation of core tax operations.

The NLNG Boss in his remarks noted that the company was a major contributor to the country’s economic development and is working towards building a better Nigeria.

He also commended the FIRS for being at the forefront of economic resuscitation and progress the country is experiencing.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, also referred to as the Road Infrastructure Tax Credit Scheme is a public-private partnership scheme signed by President Muhammadu Buhari under Executive Order 007, in January 2019, that enables the Federal Government of Nigeria to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax to the tune of the project cost incurred in the construction or refurbishment of eligible roads.

The Nigeria Liquefied Natural Gas Limited (NLNG) has received its tax credit certificate from the Federal Inland Revenue Service (FIRS) for the construction of the Bonny-Bodo Road in Rivers State.

The company is one of those engaged in building roads under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The certificate was received by the Company’s Deputy Managing Director, Mr Olalekan Ogunleye, who represented the Chief Executive Officer of NLNG, Mr. Philip Mshelbila at the handover ceremony held at the FIRS Headquarters, Abuja.

Executive Chairman, FIRS, Muhammad Nami commended the NLNG for its increased investments in Nigeria while issuing the tax credit certificate.

Mr Nami used the opportunity to highlight how the Service was improving on its relations with stakeholders, as well as building a customer-centric tax authority for improved revenue generation.

In order to efficiently deliver on its mandate, he said the Board and Management of the Service is focused on the various strategic action areas.

He said the FIRS is energising its consultations and regular engagements with stakeholders; building a customer centric and data centric organisation while also restructuring the administrative framework and processes of the Service as well as driving towards full automation of core tax operations.

The NLNG Boss in his remarks noted that the company was a major contributor to the country’s economic development and is working towards building a better Nigeria.

He also commended the FIRS for being at the forefront of economic resuscitation and progress the country is experiencing.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, also referred to as the Road Infrastructure Tax Credit Scheme is a public-private partnership scheme signed by President Muhammadu Buhari under Executive Order 007, in January 2019, that enables the Federal Government of Nigeria to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax to the tune of the project cost incurred in the construction or refurbishment of eligible roads.

The Nigeria Liquefied Natural Gas Limited (NLNG) has received its tax credit certificate from the Federal Inland Revenue Service (FIRS) for the construction of the Bonny-Bodo Road in Rivers State.

The company is one of those engaged in building roads under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The certificate was received by the Company’s Deputy Managing Director, Mr Olalekan Ogunleye, who represented the Chief Executive Officer of NLNG, Mr. Philip Mshelbila at the handover ceremony held at the FIRS Headquarters, Abuja.

Executive Chairman, FIRS, Muhammad Nami commended the NLNG for its increased investments in Nigeria while issuing the tax credit certificate.

Mr Nami used the opportunity to highlight how the Service was improving on its relations with stakeholders, as well as building a customer-centric tax authority for improved revenue generation.

In order to efficiently deliver on its mandate, he said the Board and Management of the Service is focused on the various strategic action areas.

He said the FIRS is energising its consultations and regular engagements with stakeholders; building a customer centric and data centric organisation while also restructuring the administrative framework and processes of the Service as well as driving towards full automation of core tax operations.

The NLNG Boss in his remarks noted that the company was a major contributor to the country’s economic development and is working towards building a better Nigeria.

He also commended the FIRS for being at the forefront of economic resuscitation and progress the country is experiencing.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, also referred to as the Road Infrastructure Tax Credit Scheme is a public-private partnership scheme signed by President Muhammadu Buhari under Executive Order 007, in January 2019, that enables the Federal Government of Nigeria to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax to the tune of the project cost incurred in the construction or refurbishment of eligible roads.

The Nigeria Liquefied Natural Gas Limited (NLNG) has received its tax credit certificate from the Federal Inland Revenue Service (FIRS) for the construction of the Bonny-Bodo Road in Rivers State.

The company is one of those engaged in building roads under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The certificate was received by the Company’s Deputy Managing Director, Mr Olalekan Ogunleye, who represented the Chief Executive Officer of NLNG, Mr. Philip Mshelbila at the handover ceremony held at the FIRS Headquarters, Abuja.

Executive Chairman, FIRS, Muhammad Nami commended the NLNG for its increased investments in Nigeria while issuing the tax credit certificate.

Mr Nami used the opportunity to highlight how the Service was improving on its relations with stakeholders, as well as building a customer-centric tax authority for improved revenue generation.

In order to efficiently deliver on its mandate, he said the Board and Management of the Service is focused on the various strategic action areas.

He said the FIRS is energising its consultations and regular engagements with stakeholders; building a customer centric and data centric organisation while also restructuring the administrative framework and processes of the Service as well as driving towards full automation of core tax operations.

The NLNG Boss in his remarks noted that the company was a major contributor to the country’s economic development and is working towards building a better Nigeria.

He also commended the FIRS for being at the forefront of economic resuscitation and progress the country is experiencing.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, also referred to as the Road Infrastructure Tax Credit Scheme is a public-private partnership scheme signed by President Muhammadu Buhari under Executive Order 007, in January 2019, that enables the Federal Government of Nigeria to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax to the tune of the project cost incurred in the construction or refurbishment of eligible roads.

The Nigeria Liquefied Natural Gas Limited (NLNG) has received its tax credit certificate from the Federal Inland Revenue Service (FIRS) for the construction of the Bonny-Bodo Road in Rivers State.

The company is one of those engaged in building roads under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The certificate was received by the Company’s Deputy Managing Director, Mr Olalekan Ogunleye, who represented the Chief Executive Officer of NLNG, Mr. Philip Mshelbila at the handover ceremony held at the FIRS Headquarters, Abuja.

Executive Chairman, FIRS, Muhammad Nami commended the NLNG for its increased investments in Nigeria while issuing the tax credit certificate.

Mr Nami used the opportunity to highlight how the Service was improving on its relations with stakeholders, as well as building a customer-centric tax authority for improved revenue generation.

In order to efficiently deliver on its mandate, he said the Board and Management of the Service is focused on the various strategic action areas.

He said the FIRS is energising its consultations and regular engagements with stakeholders; building a customer centric and data centric organisation while also restructuring the administrative framework and processes of the Service as well as driving towards full automation of core tax operations.

The NLNG Boss in his remarks noted that the company was a major contributor to the country’s economic development and is working towards building a better Nigeria.

He also commended the FIRS for being at the forefront of economic resuscitation and progress the country is experiencing.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, also referred to as the Road Infrastructure Tax Credit Scheme is a public-private partnership scheme signed by President Muhammadu Buhari under Executive Order 007, in January 2019, that enables the Federal Government of Nigeria to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax to the tune of the project cost incurred in the construction or refurbishment of eligible roads.

The Nigeria Liquefied Natural Gas Limited (NLNG) has received its tax credit certificate from the Federal Inland Revenue Service (FIRS) for the construction of the Bonny-Bodo Road in Rivers State.

The company is one of those engaged in building roads under the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme.

The certificate was received by the Company’s Deputy Managing Director, Mr Olalekan Ogunleye, who represented the Chief Executive Officer of NLNG, Mr. Philip Mshelbila at the handover ceremony held at the FIRS Headquarters, Abuja.

Executive Chairman, FIRS, Muhammad Nami commended the NLNG for its increased investments in Nigeria while issuing the tax credit certificate.

Mr Nami used the opportunity to highlight how the Service was improving on its relations with stakeholders, as well as building a customer-centric tax authority for improved revenue generation.

In order to efficiently deliver on its mandate, he said the Board and Management of the Service is focused on the various strategic action areas.

He said the FIRS is energising its consultations and regular engagements with stakeholders; building a customer centric and data centric organisation while also restructuring the administrative framework and processes of the Service as well as driving towards full automation of core tax operations.

The NLNG Boss in his remarks noted that the company was a major contributor to the country’s economic development and is working towards building a better Nigeria.

He also commended the FIRS for being at the forefront of economic resuscitation and progress the country is experiencing.

The Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, also referred to as the Road Infrastructure Tax Credit Scheme is a public-private partnership scheme signed by President Muhammadu Buhari under Executive Order 007, in January 2019, that enables the Federal Government of Nigeria to leverage private sector capital and efficiency for construction, refurbishment and maintenance of critical road infrastructure in the country.

Under the Scheme, participants are entitled to tax credits against their future Companies Income Tax to the tune of the project cost incurred in the construction or refurbishment of eligible roads.