U.S Democratic-controlled House of Representatives committee on Friday released six years of former president Donald Trump’s tax returns to the public in an extraordinary move, days before Republicans are due to take control of the chamber.

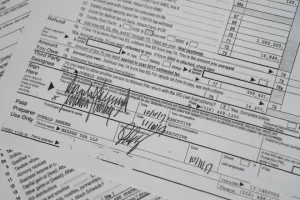

The returns, which include redactions of some personal sensitive information such as Social Security and bank account numbers, are from 2015 to 2020. They span nearly 6,000 pages, including more than 2,700 pages of individual returns from Trump and his wife, Melania, and more than 3,000 pages in returns for Trump’s business entities.

The release of Trump’s redacted returns for 2015 to 2020 caps a multi-year battle between the Republican former president and Democratic lawmakers that was settled only last month by the U.S. Supreme Court.

It is the latest blow for the former president, who was impeached twice by the Democratic-led House only to be acquitted both times by the U.S. Senate, and now faces multiple legal issues as he mounts a 2024 re-election bid.

Their release comes after a party-line decision last week in the House Ways and Means Committee to make the returns public.

Republicans warned that the revelation would establish a dangerous precedent weakening privacy protections, while Democrats contended that transparency and the rule of law were at issue.

Earlier this month, the House committee investigating the January 6, 2021, attack on the U.S. Capitol asked federal prosecutors to charge him with four crimes, including obstruction and insurrection.

Trump broke with tradition by not releasing his tax returns when he ran for president. He also fought in court to keep them hidden while in office. However, the Supreme Court declined last month to stop the Treasury Department from giving them to the Ways and Means Committee, which drafts tax laws.

According to a report released last week by Congress’ nonpartisan Joint Committee on Taxation, Trump paid $641,931 in federal income taxes in 2015, the year he launched his presidential campaign. He then paid $750 in 2016, $750 in 2017, nearly $1 million in 2018, $133,445 in 2019, and nothing in 2020.

According to the forms made public on Friday, more than 150 of Trump’s corporate organizations reported negative qualified business revenue for 2020. The IRS defines qualified business income as “the net amount of recognized items of income, gain, deduction, and loss from any qualified trade or business.” Trump’s qualified losses for that tax year totaled more than $58 million, when combined with approximately $9 million in carryforward losses from previous years.