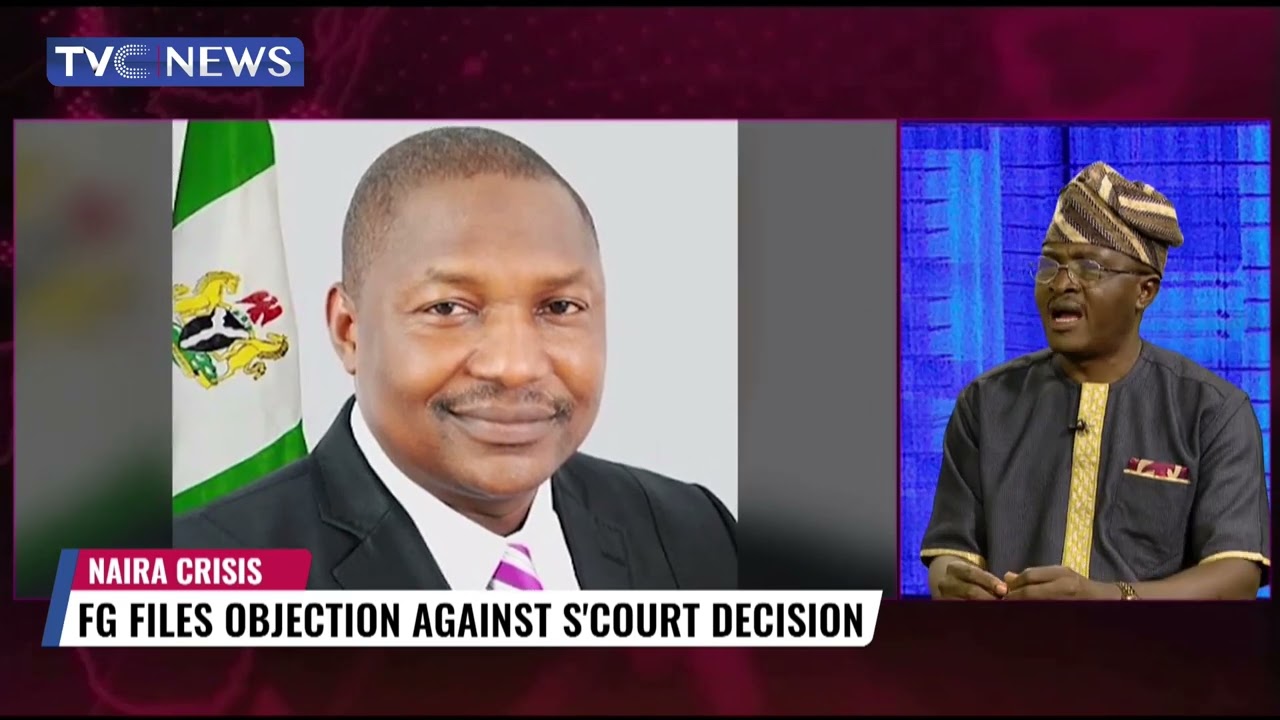

The Attorney General of the Federation and Minister of Justice Abubakar Malami has written a letter to the Supreme Court asking it to dismiss a suit filed by three state governments challenging the naira redesign policy of the Central Bank of Nigeria.

In a preliminary objection filed by the AGF of the federal government argued that the Supreme Court lacks jurisdiction to entertain the suit.

With reference to section 251 of the Constitution, Mr Malami argues that the suit falls within the exclusive jurisdiction of the federal high court in matters of monetary policy of an agency of the federal government.

The governors of Kaduna, Kogi and Zamfara States earlier sued the federal government over the naira redesigned policy of the CBN that has brought untold hardship on Nigerians in sparked pockets of protests in different parts

of the country.

Lawyer/Public Affairs Analyst, Jide Ologun speaking on TVCBreakfast said the Supreme Court is the face of first and last instance between the state and the federation.

The CBN should have gone through the federal High Court like the binary objection is trying to point out, this time around, the three states went after the Federation on a policy.

“There is what we call vicarious responsibility, not directly targeted at CBN as an institution but at a policy that the implementation is throwing the state into crisis.

“There is shortage of food, people are protesting, this has brought untold hardship on the people”.

“Even the Deputy Governor of the central bank already came out to admit that they did not evaluate the ecosystem of this policies implementation, now we have a crisis at hand.

“The IMF and even the national security adviser, Babagana Mungono had warned us.

According to Mr Ologun, when a project is tested, and failure is discovered, it doesn’t come midway, rather it comes abinitio, at the point of conception.

Citing a case of India, the policy analyst said “in 2016 when India decided to withdraw the 500 and 1000 rupees for the same reason of going after black marketers, tax evaders and trying to introduce a cashless economy, it failed woefully because you have about 190 million Indians that are not having access to the cashless policy, it failed woefully.

“The United Kingdom recently, after the demise of the Queen, there is a change in the configuration of the currency, but it will not be fully introduced into the mainstream until the middle of 2024”.

Speaking further, the INEC Chairman has revealed that Central Bank

is the banker of INEC so that shouldn’t be a problem, the NNPC has also said it will make fuel available.

Nigerians have said there maybe a cabal somewhere trying to disrupt the forthcoming election and this is being justified.

Mr Ologun who stated that naira redesign policy is a good one added that implementation is a problem especially as there are no infrastructural backup.

“How many persons have access to internet banking.

“As a lawyer one of the major problems we have is when people transfer money does not go and some banks are asking for a court order.

“We expected that the stakeholders should have sat down to evaluate the value chain of this policy to avoid this embarrassment.

“When the EndSars protests landed It took the interventions of the guns to quell it, if this cash locked down starts its own trouble, how are we going to manage it”.

Talking about the fuel scarcity, Mr Ologun stated that we have brought a change that is linked up with an existing hash change of fuel increase in voluntary fuel increase pump price, scarcity, scarcity of electricity even when what we pay has been increased through the back door.

Malami should not also be ignorant if the concept of leadership is understood.

The issue is not against the CBN but against the policy that involves the Central Bank that is likely to throw the nation into Anarchy.

Mr. Ologun recalled that before extending the date of making these currencies legal tender on 31st of January to the 10th of February, the CBN Governor went to Daura to receive directive from the president, according to the policy analyst, this contravenes the independence of CBN under the Constitution.

He added that it will be an aberration on the nation if the president is being misled.

“We need to develop our system to the point where you are not afraid of leaving office.” Mr. Ologun added.