The Nigerian Deposit Insurance Corporation says it is set to pay depositors of the liquidated Heritage Bank before the end of the week.

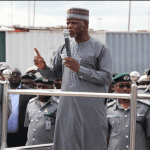

The Managing Director of NDIC disclosed this at a media briefing in Abuja on the liquidation of the bank.

He said the total number of depositors in the bank is 2.3 million with 99 per cent of them having account balances less than five million naira.

On the 3rd of june, the Central Bank of Nigeria revoked the banking licence of Heritage Bank Plc due to the bank’s inability to improve its financial performance.

The regulator said Heritage Bank, which was nationally licensed, has not improved and has no reasonable prospects of recovery.

The NDIC as part of its mandate is set to give depositors their money.

In the briefing, it says it will not take more than 30 days to pay positives as stipulates in its act.

The corporation says it would pay a maximum of N5 million insured deposits to each customer of the bank.

NDIC adds that the total bank deposits at heritage bank is N650 billion while it’s loan portfolio stands at over N700 billion.

He explained that only about 4000 depositors have above N5 million in their accounts.

NDIC is established to protect depositors and contribute to the stability of the financial system through effective supervision of insured institutions.