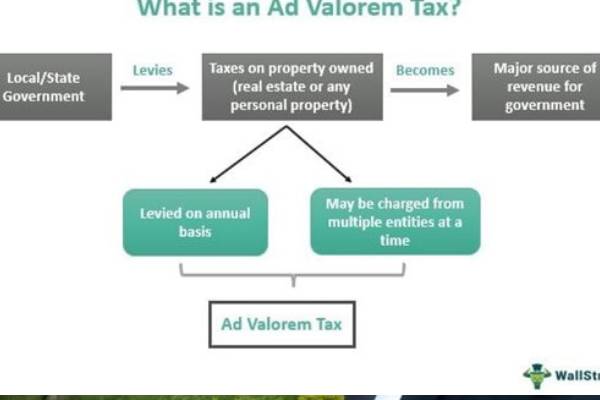

Economic and Policy Expert, Olufemi Awoyemi, has called for caution on the part of the Federal Government in its quest to increase Revenue through Taxation and the introduction of the Advalorem Tax.

Mr Owoyemi who is the founder of Proshare an Economic Think Thank said the move to introduce Advalorem Tax in Nigeria by the Federal Government is one that requires a lot of wisdom and care so as not to create more problems than it was designed to solve.

He added that the government must engage in a conversation with the Manufacturing Sector before the imposition of the Advalorem Tax to ensure it is done in a sustainable manner.

He disclosed what he described as cautious optimism for the future outlook for Nigeria despite the fact most of the World will be facing a recession in 2023.

He urged government at all levels to prepare for this and also work at making use of the positives from the anticipated recession in much of the world.

Read More Below and Watch on Youtube…

“You started by saying what was the situation? So it’s important that we understand the trajectory of the Nigerian economy before the 2020 pandemic, and the trajectory was the global effect. We were already facing some difficult headwinds on our own, and by the time those things happen, there was a serious effect which also affected the Nigerian economy. The cold hard facts means that we must decouple those two things to understand the implication on the supply chain management effect on our manufacturing industry”.

“So, if we take a look at the manufacturer CEO’s confidence index computed for 2021 released by MAN itself, it showed that the industry has recorded a mass recovery from COVID-19”.

“However, it was consistently identified growing economic headwinds for the manufacturers i.e in security, foreign exchange challenges, high cost of locally imported raw materials, a deficit skilled map of high technology adoption costs, a number of inconsistent government policies. And if you take a look at the manufacturers competence index over the years, you will see that there’s a problem already brewing in the industry.

“But how did government react? Over the years? Government has reacted in different forms. But you ask the question why did the government want to do this? The answer is simple. Nigeria has a revenue challenge and it needs to address it. And the most efficient way to address this is to take a look at the taxes.

“So obviously, government supported by IMF and World Bank have been looking at ways to address this problem. And this has culminated in a number of position papers and a number of submissions leading up to the most recent position by the IMF asking that certain sectors of the economic taxation has to be improved upon now if it has to be improved upon.

“There were also four other criteria that the IMF spoke about. And this is where we talk about fiscal policy, management issues and challenges. So if you take one side and leave the other side you are able to create a conundrum.

So that means the whole intentions you set up for yourself will be defeated and that’s where we are right now. And this whole idea that we wanted to do advalorem tax which is in principle and principle sorry, make sense for the government to do, I support it but there is a single factor narrative here at play makes no sense. That means advalorem requires that you understand your economic recovery of you also understand that it’s a function of productivity.

In the absence of both and the fact that consumer purchasing power is dropping, you are going to be in a conundrum so that the increase in taxation, you envisaged will not happen.

If I get your question correctly you are asking that the government is trying to solve his own problem and also in fulfilling its mandate as a government to raise taxes and create revenue for it to fund this program decides to do this on it. What would they affect?

There are three categories of people that this will affect it will affect government, it will affect companies and it will affect citizens themselves, how do I position this a component of taxation and valuable excise on its own. Do not look in isolation. Don’t forget that this was an industry when we passed the Finance Act we included a N10 per Litre for which incredible amounts of money have been paid in terms of excise already.

So you are taxing production while you’re also taxing consumption. So you’re taxing this particular sector which produces about 30% of your manufacturing sector in terms of this capacity and ability to produce. That’s where you find your situation. Now if I take it first and say how would this affect this entity? Let’s take it from the optimized person that it will affect, which is it citizens.

It will affect them at two levels. One, there’s going to be relative adjustments by the company which would need to job lay offs and most importantly in the living standards of those who fall into the lower income.

Interestingly today a report just came out from Kingsley Moghalu’s think tank which talked about the level of poverty in the country which means that people at that base level have a social connection with the carbonated drinks industry, i.e birthdays functions ceremonies including in fact wedding list.

“This will bring you some drinks or whatever you have. Now, this will affect them in many ways that it will create alienation in some and for some others will be preparation. The second one is that the relative affordability of carbonated drips means that the local brewing industry on the other hand like something like Zobo and others naturally that’s what government would expect.

But that is not going to be the case because these other drinks are not subjected to factory cook.

So what government is doing is on one hand the formal setup which you can tax, which you can levy things for, you are frustrating them enough to push them to the untouchable area of the informal setup which then means that we’re actually paying the classical cobra effect.

Second aspect for companies themselves excise Tax duty would obviously, and I mean our society translates to an increase in the unit cost of goods. Don’t forget for some who took on the N10 they try to pass a 5% increase and every one of us will know that 5% increase did not solve the problem because for most of them the data available to us at Proshare suggests that about 25% in value loss was achieved.

“So which means that they’ll be following the demand for their goods which will also induce further operational resizing. But the most important one is that for certain of those companies, they would have to suspend their capital project plans, which would affect FDI will also affect the ability for them to get money to reinvest, to deal with Technological changes which they have to make in my perturbing to achieve efficiency, To cope with the first N10 have from the government position, There are two major impacts. One will have to be about fiscal policy, the second will be about national productivity. Introducing excise duties is not even a problem. The tax can be done in a way that recognizes the rate of economic recovery. So that means you are actually taxing in relations to the ability to be more efficient. So here we have a conundrum. On the one hand the government needs to increase taxes and where they go for in most countries is well called the same taxes.

“I mean i.e eat drinks, cigarettes, tobacco, all those other things which people can’t necessarily at a point created marginal value where they can say they can do that. But at the same time we also want to make sure that these organizations are keeping the social balance in place, which then leads to the question that one of the gaps in public policy is that we have brilliant ideas to increase revenue of the government for the social impact assessment of it which will raise issues like timing the rate at which you increase or the flow at which you do so is no longer there.

“So we end up with a militarized mindset whereby just a government is box this is it. There’s no conversation and there’s nothing. So we’re in a conundrum right now and for every one of us it’s important that we understand the conversation around this particular advalorem tax.

“So with this specifically as you mentioned, IMF is not entirely inaccurate in position. maybe what they have done was that they may have over generalized their assumptions in terms of the social impact. Maybe they must have considered that this is an inelastic sector whereby nothing happens.

For example we joke in Nigeria that when we are sad we drink but we are happy. We drink but we don’t have anything to do with drink. We just patch. But I think they are over assuming because in the last five to a decade the trends have been adjusting relative to consumer purchasing power which we’ve seen and nothing has been much worse than what has happened betwenn 2020 and today.

“So that’s on one side. But there is also the principle about the advalorem tax. The ad Valorem tax principle measures increases with the productivity baseline. That is the whole essence of advalarium without establishing a productivity baseline which emphasizes economic recovery crops to know when things are good so you can adjust your tax in a productive manner to take your productivity with the addresses consumer purchasing power issues and overall productivity. Truth is that if these things are not done, we have a problem. Yes, I honestly believe there are difficult choices ahead for the nation. Like one of my colleagues once said eating hot soup requires patience.

And so does Fiscal policy. So when you ask what are the alternatives? There are a few less hazardous alternatives for us. There are a few things I have spoken about concerning internalization of revenues hijacked by non state actors. For example, the government’s focus is on revenue.

“Secondly, we have a financialising government assets which government is already concluding and looking up. But the means that with the approach they also face the same problem we are addressing now, they third would be about, say, establishing market values for public assets by leaving a good asset trading just like what Saudi Arabia or to go to look at the Indian example is to list public assets available for investment on a national register.

But that would require us to resolve the public private partnership or drug we face. But specifically on this issue with this sector the more easier ones for us to look at will be to for us to take into consideration the way in which we can find a middle road ie. Every government considers raising taxes by modest percentage not up to 5% which will therefore will be an adjusted rate relative to their own price increase as well.

So that means they would not have suffered any losses, but they would not have gained any benefit, but at least they would have been seen as a sector. And they will have a limit over a period of time to adjust the scene. And that’s where conversation comes in. There’s one hand to raise the policy, but the most important thing is for us to have that conversation with the decision makers and the industry,They can have those conversations. It is important that we do so because from our model this would not be a very smart idea if we follow through.

So here’s the reality of the developing economy, or an emerging market specifically. Here’s the reality of Nigeria, Every one of us must understand that the federal government has a large debt too. There’s a limit to which you can borrow. You can create bonds at the local level. There’s a limit. There are some conversations that need to be had at the level of the public policy and sobering governance of Nigeria that we’ll be kicking down the can. And it’s not even the subject of the current debate for the new election. There’s a serious problem. So the government has a large problem. Every stakeholder, including of the organised private sector, we have a role to contribute to how to build the revenue of the federal government.

And I believe that there is no other industry, as well as a lot of the manufacturers who themselves understand that they play a role. You saw what happened during the covid crisis where the supply chain disruption, whether we went towards protection.

Now, if we don’t have a manufacturing base, I would not put ourselves to the importing. The government also recognized that it has to keep his manufacturing base at a more efficient level. And maybe some of them may benefit from this conversation to improve efficiency. But generally we have to change and help government. What I believe the larger conversation is is that how does government move from the point where it is and stop making the argument that Nigerians are paying less than other countries.

But if you look at the other leases in those other countries when they are judging what it is because they tell you that there’s a moral question about what’s the value. So if we move away from the moral question and we’re dealing with a corporate entity every one of these corporate entities and you mentioned if you need to see the subset of I believe they are responsible enough to understand that an engagement with government will mean that at some point, this is some conversation that we have. How they go about it, how they avoid a single factor narrative from the federal government just insisting and giving military orders to say, you pay the following tax matters because governments in the short term enforce them to pay this revenue.

In the long term government will suffer suffering multiple forms. One, productivity will suffer, so the revenue will be fined. Secondly, there will be other areas of where people produce products that you drive them to the underground and then you cannot capture the revenue, which makes it even worse. The third most important thing is that you find a fairly productivity capital flight in the one area. Those who want to invest cannot invest because you can move from the 10% to 20%. What stops you from moving to 30% tomorrow, which therefore means that will impact lower for a direct investment that job losses will be natural because companies will right size in order to keep themselves afloat.

But at some time the ability for them to replace machinery or whatever means there’s an issue. The final issue around this thing is that for a sector that is representing 30% of the whole 2020 battery sector, which is responsible for 30% of the GDP of the country, that is not a decision without having what you call an impact assessment, analysis and conclusion whereby you just adjust what you want to do.

It is not about what you need to do, which I believe every one of us would agree, anybody who does this country would agree. That is important, but it is unintelligent and actually spikes of ignorance of how markets work. For you to suggest that an introduction, of Tax of such nature will make any difference in terms of your revenue drive. In fact, you may be shooting yourself in the foot.

Well, for those who are in the business of deciding on outlook, that’s a very interesting area for which they should be well paid because I’m sure that for anyone who understands the number of factors that are creating a headwind in Nigeria, the outlook for the country in 2023 is one of measured optimism. If there ever is anyone because of the global headwinds that you see happening in terms of recession across the globe and our ability or inability to have both of us to provide absorbers for the shock waves that will come. And from an internal perspective, there are just a mild ride of issues that we need to deal with. Having said that, however, trained analysts have learn to look at the opportunities, of course, in generations you find that this cycle repeats itself.

And so thinking of a government walking through the public private sector arrangement that has been going on and one must give credit to governments in that regard, is that we can therefore understand where it will work.

However, the major challenge is that it can work for a few the way we have done it up to now. Why does it work for the generality of everybody? And if you cannot make sure that the average person is able to have disposable income, your growth is also stunted by that. So the applicable wisdom is measured optimism.

Little enthusiasm on my part in terms of what changes we expect but I think it’s just a measured enthusiasm because we passed this road before. I don’t tell you it’s old enough. I’ll leave the analysts who are good at it to conclude in a weekend in some areas, especially in to this subject, I am passionately concerned that we do have very highly intelligent men in the world who are knowledgeable about the economy, finance, markets, taxation and how it works together.

It is therefore mindful that the responsible thing for us to do is to sit down and work with the industry through some numbers. And then we can then find a way to build up. And not just this industry, every other industry. Because productivity is low. People are even thinking of shutting down and stuff is happening. And you can see all this. If everyone overseas is preparing for a recession, if there’s a global recession, where are we planning for the upside now?

We are now challenging our businesses themselves. We are facing a very dire consequence in that. And so, in summary, government is right to consider revenue increases through taxation, the advalorem tax if expanded fully. Well, it’s also a good concept, but when you do it, how you do it and how much you do it, are the issues that are going to resolve. And without lack of clarity, a lot of things can go southward.

So as it is today, without clarity from how government wants to do so, or an engagement whereby not only just the subject of understanding, but those who are in charge of commenting on the economy, also understanding, it’s not a decision that suggests that wisdom is at play here.