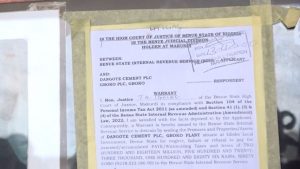

The Benue State Government through its Internal Revenue Service, BIRS, has sealed up the offices of the Jos Electricity Distribution Company, JED, in the state and a cement manufacturing company over N634.1million unpaid accumulated taxes.

Leading the enforcement team to shut the organisations, the Executive Chairman of BIRS, Mimi Adzape-Orubibi, explained that the action was in compliance with the provisions of the Personal Income Tax Act of 2011.

She went on to say that the enforcements were necessary because all of the proper procedures had been followed, but the taxes remained unpaid.

The taxes, according to Adzape-Orubibi were in default to the tune of over N433.1million and after several discussions and notifications as well as being served the mandatory notices to pay up

The executive chairman of BIRS stated that an audit was carried out on the cement company whose letter was dated 9th of January, 2021 and it was N474million.

After reconciliations and virtual reconciliations, the service came down to the final amount of N218million.

The cement company did not object to the assessment, so a suit was followed with 14 days notice with additional seven days notice with no response.

In response to the development, the JED Director of Corporate Services, Adakole Elijah, urged BIRS management to reconsider the action, stating that while the injector sub-stations were not sealed, operations began from the administrative offices because that is where management operates.