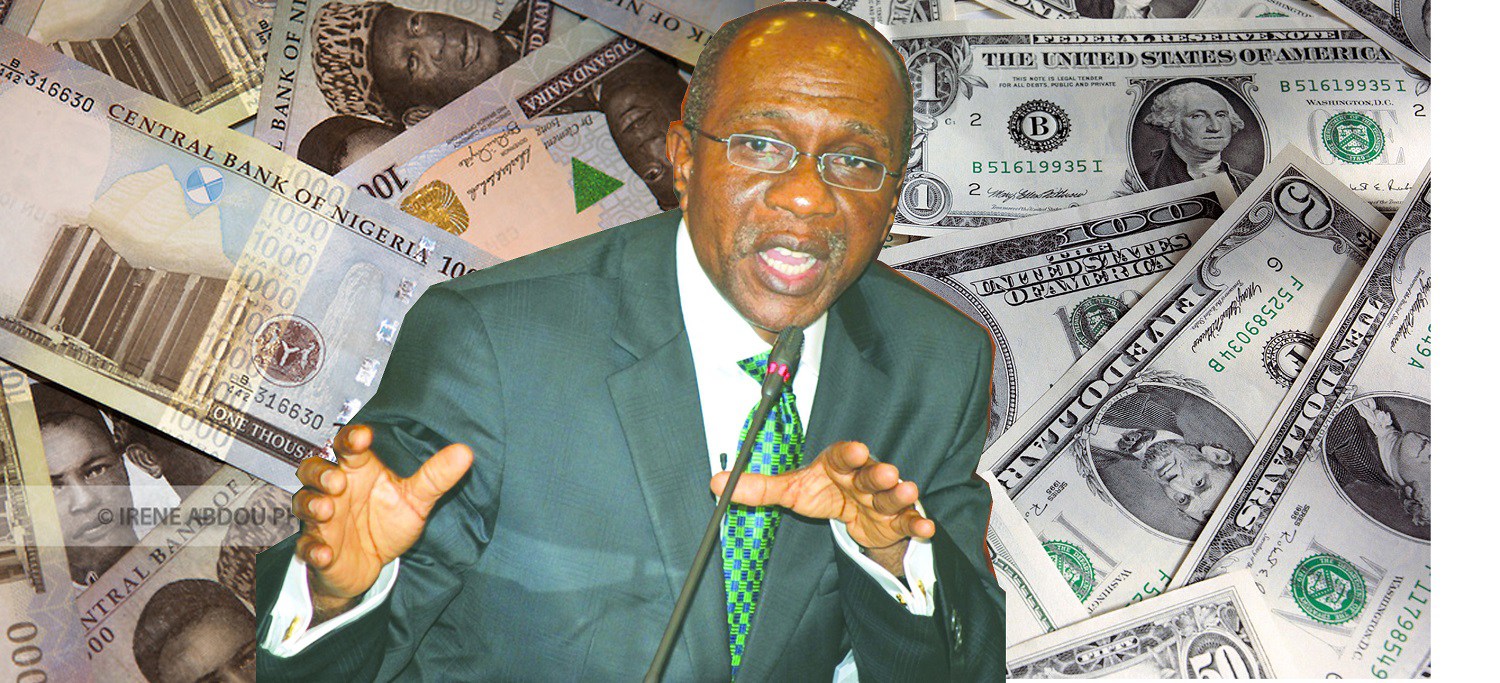

TVC N. Today’s Central Bank of Nigeria (CBN)-led Monetary Policy Committee (MPC) meeting will push for exchange rates convergence and the shoring up of the naira’s value, it was learnt yesterday.

MPC members are targeting how to ensure that the gap between official and parallel markets shrink further and engender confidence of international investors in the economy.

The naira continued its strong show against the dollar at the weekend, underscoring the resolve of the apex bank to achieve convergence of rates between the interbank and Bureau de Change segments.

The dollar along with other convertible currencies at the end of last week crashed against the naira, which gained at the parallel market, exchanging at between N376 and N380 to $1 as against the N390 and N385 at which it exchanged a week earlier.

However, in other segments of the market – Deposit Money Banks (DMBs) and Travelex, the naira was trading at or below N362 to the dollar. The official market rate stood at N306 to the dollar.

The CBN said at the weekend that it remained committed to ensuring a convergence of forex rates and that the recent gains would be sustained. The apex bank will continue its interventions to ensure the stability of the naira.

It noted that the windows established for Small and Medium Enterprises (SMEs) and for investors and exporters continued to yield the desired results by providing access to forex and easing pressure on the market.

CBN spokesman Isaac Okorafor reiterated the CBN’s commitment to ensuring that there is enough supply of forex to genuine customers to achieve forex rates convergence.

The Manufacturers Association of Nigeria (MAN) urged the CBN to drop the lending rate from 14 per cent so as to accelerate productivity and economic growth.

MAN President Frank Jacobs told the News Agency of Nigeria (NAN) that the MPC needed to review the lending rate downward because the high interest rate regime had stifled growth, productivity and competitiveness of manufacturers.

He noted that with the appreciation of the naira and further drop in inflation rate, friendlier policies that would stimulate economic growth and boost production should be embraced.

Jacobs also urged the CBN to create five per cent concessionary interest rate for manufacturers to drive the nation’s diversification agenda and increase contribution to the Gross Domestic Product.

“If manufacturers have access to low interest rate as done in other climes, we will be able to employ more people and create wealth for the nation through tax,” he said.

Jacobs said with concessionary interest rate, manufacturers would be able to expand their businesses, create wealth, boost productivity and catalyse economic transformation.