The Information Security Society of Africa-Nigeria (ISSAN) has called on the various financial institutions in Nigeria to beef up cyber security in order to reduce the risk of cyber attacks and also, to protect organisations from the deliberate exploitation of systems, networks and technologies.

The call was made by at the just concluded industry round table for information security stakeholders of banks in Nigeria themed: “Cyber Resilience In Organisations,” which held in Lagos recently.

The president, ISSAN, Dr. David Isiavwe, said cyber resilience was mandatory for all organisations, saying there is no telling where or when the next attack would happen.

While addressing various financial stakeholders he said, “the world of cyber security keeps changing every day, looking somewhat amorphous.”

“The threats are not going away soon and they are fueled by increased dependence on technology by organisations attributable to the emergence of digitization.

“The financial sector is particularly attractive to the attackers given its crucial role in a highly connected global financial system.”

The Director, Banking and Payment system, Central Bank of Nigeria (CBN), Mr. Dipo Fatokun who was represented by the Deputy Director, Banking and Payments System Policy, Mr. Musa Jimoh, urged CEOs, Board of Directors, Senior Executives to ensure that they always take the right decisions about cyber security for their institutions, stating that they must make it clear that security is not just an IT problem.

Speaking further, he explained, “It is a priority for businesses. CEOs therefore need to be able to answer tough questions and prove that they are working with the senior leadership teams to develop a Cyber security strategy and how it can affect key business functions as a company. “Indeed, CEOs should learn more about cyber security to ensure that their companies are taking appropriate actions to secure their most valuable information.

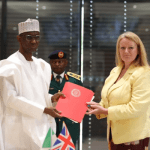

“These round table events help to propel cyber risks agenda forward and generate new ideas towards strengthening cyber resilience. We have signed a Memorandum of Understanding with relevant organisations in the United States of America and all current bodies to mitigate the risk of cyber security breaches in Nigeria.”

He further said: “We should embrace this opportunity and collaborating approach to keep cyber attacks at bay as much as possible towards ensuring a sound, stable and efficient financial system.

“The need for alertness within our industry is more than ever before very crucial. Regulations and compliance are now mandatory for all of us as CBN has put the issue of cyber security on the front burner.”

The Director, Other Financial Institutions Supervision Department, CBN, Mrs. Tokunbo Martins in her presentation said, “In recent times, Cyber security threats have increased in number and sophistication as banks and payment service providers (PSPs), use information technology to expedite the flow of funds among entities.

“Threats such as ransomware, targeted phishing attacks have become prevalent, demanding that DMBs and PSPs remain resilient and take proactive steps to safeguard their critical information assets including customer information that are accessible from the cyberspace.

“Therefore, cyber security resilience must be fully integrated into business goals and objectives and must be an integral part of the overall risk management processes to provide an assurance of sustainability for the organisation using its governance, interconnected networks and culture,” she added.