Information technology involves the use of electronic gadgets especially computers for storing, analyzing and distributing data.

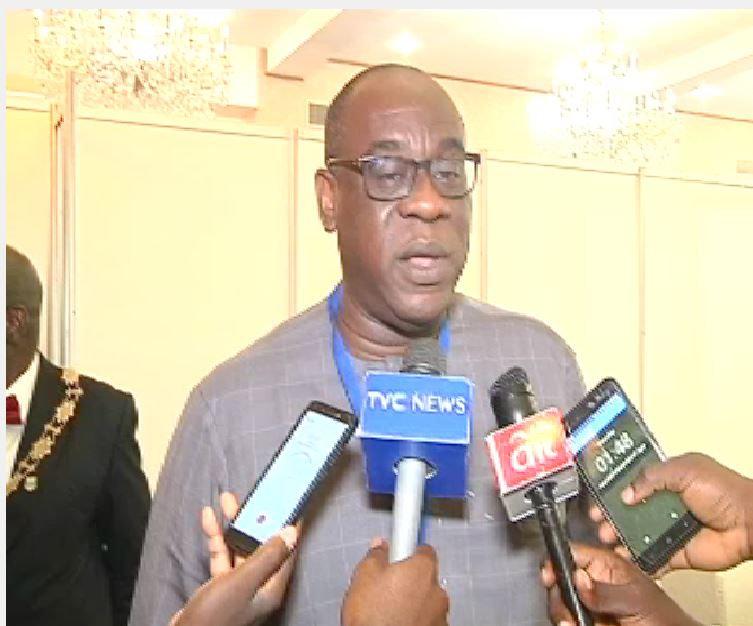

Deputy governor of the central bank of Nigeria, Adebisi Shonubi wants Professional accountants to take advantage of the technological advancement in the banking industry.

He says with proper infrastructure in place, Nigeria’s financial services sector will compete favorably with international partners.

This development is having a dramatic influence on almost all aspects of individual lives and that of the national economy including the banking and financial services sector.

The conference is the first of its kind put together by the institute of chartered accountants of Nigeria, the focus is disruptive technologies the game changer for businesses.

In recent times, the banking industry has continued to contend with multiple challenges occasioned by regulations,disruptive models and technologies, speakers here say financial institutions must be set to face these challenges for sustainable growth.

Financial journal of PWC in Africa shows that Fintech investments are estimated to have increased by a compound annual growth rate of over 58 percent between 2014-2016 to 800 million dollars.