The failure of Nigeria’s president to appoint a cabinet four months after winning a second term has stymied the country’s stock market, prompted foreign investors to trim holdings and threatened growth prospects for Africa’s largest economy.

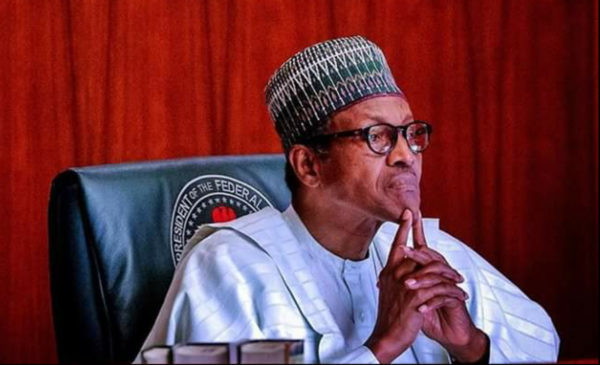

Inaugurated on May 29, Muhammadu Buhari, Nigeria’s 76-year-old former military leader, faces a long list of challenges including tepid economic growth, high unemployment and a decade-old Islamist insurgency.

Government activities, which almost ground to a halt ahead of February’s election, slowed further after his victory, leaving foreign investors trying to gauge how much of a hit the stock market will take from the hiatus.

“It is massive,” said Andrew Brudenell, lead senior portfolio manager for frontier markets equities at Ashmore Group. “Even when oil prices were back up at $70 heading to $80 again, the stock market did not do anything. They (stocks) just continue to trickle down as people give up on their investments.”

The stock market in Nigeria, Africa’s top oil producer, has failed to keep up with frontier markets peers, a subset of smaller and often riskier emerging economies. The MSCI Nigeria index has dropped more than 15% since the start of the year, making it one of the worst performing markets in the index, even as the wider MSCI Frontier Market index rallied nearly 10%.

Nigerian politics often move at a glacial pace. Buhari took six months to swear in a cabinet after the 2015 election – a delay critics contend contributed to the slow response to low oil prices that pushed Nigeria into a recession in 2016.

But some investors said they had hoped that as the incumbent, he would move more quickly. Senegal’s Macky Sall and South Africa’s Cyril Ramaphosa both appointed ministers within days of being sworn in as president this year.